Introduction To Bse And Its Importance

Brief History Of Bombay Stock Exchange

Bombay Stock Exchange (BSE) holds a significant place in the history of the Indian financial market. Established in 1875, it is Asia’s oldest stock exchange. Initially, trading took place under a banyan tree, and later, the BSE moved to Dalal Street in Mumbai. Over the years, it has played a pivotal role in shaping India’s financial landscape.Role Of Bse In Indian Economy

BSE serves as a barometer of the Indian economy, reflecting its growth and health. It provides a platform for companies to raise capital through equities, debt, and derivatives. Additionally, the BSE Sensex, comprising top companies, influences investor sentiment and global market trends, making it a critical player in the nation’s economic development.

Navigating The Bse Stock List

Investing in the stock market can be a daunting task, especially for beginners. With thousands of companies listed on the Bombay Stock Exchange (BSE), it can be overwhelming to navigate through the stock list and find the right stocks to invest in. However, understanding key segments and sectors and market indices can make it easier to narrow down your options and make informed investment decisions.Key Segments And Sectors

The BSE stock list is divided into different segments and sectors, making it easier to identify companies based on their industry. Some of the key sectors include banking, healthcare, technology, energy, and consumer goods. By understanding which sector a company belongs to, you can get a better idea of its potential performance and growth prospects.Understanding Market Indices

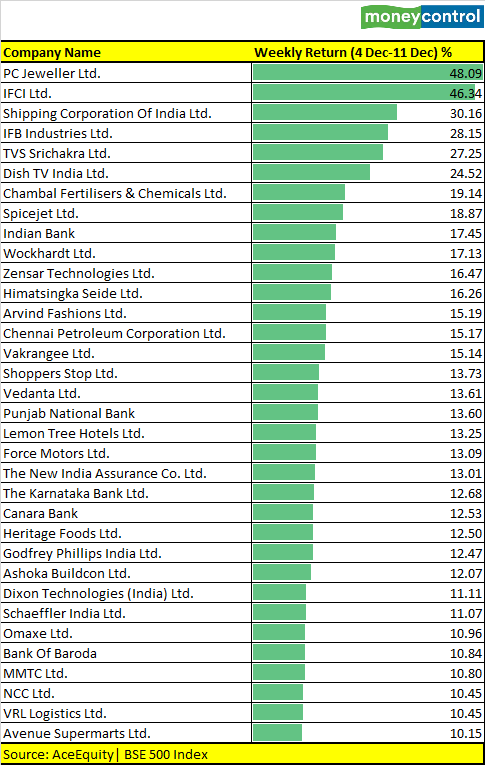

Market indices are a way of measuring the overall performance of the stock market. The BSE has several indices, including the BSE Sensex and the BSE 500. The Sensex tracks the performance of the top 30 companies listed on the BSE, while the BSE 500 tracks the performance of the top 500 companies. By keeping an eye on these indices, you can get a sense of the overall market trends and how different companies are performing relative to the broader market. Overall, navigating the BSE stock list requires a bit of research and analysis, but understanding key sectors and market indices can make the process much easier. By taking the time to understand the different segments and sectors and keeping an eye on market trends, you can make informed investment decisions that align with your financial goals.Decoding Stock Prices

Understanding stock prices is crucial for investors who want to make informed decisions in the stock market. Decoding stock prices involves analyzing various factors that influence them and reading the price table effectively. By gaining a deeper understanding of how stock prices work, investors can identify potential opportunities and manage their investments more effectively.Factors Influencing Stock Prices

Several factors can influence the price of stocks. It’s important to consider these factors when analyzing stock prices:- Company Performance: The financial performance of a company, including its revenue, profit margins, and growth prospects, can impact its stock price. Positive performance indicators often lead to higher stock prices.

- Market Conditions: The overall state of the stock market, including economic factors, industry trends, and investor sentiment, can influence stock prices. Bullish markets tend to drive stock prices higher, while bearish markets can cause them to decline.

- Supply and Demand: The balance between the number of shares available for trading (supply) and the number of investors interested in buying those shares (demand) can affect stock prices. When demand exceeds supply, stock prices generally rise.

- Interest Rates: Changes in interest rates can impact stock prices. Lower interest rates may encourage investors to invest in stocks, leading to higher prices, while higher interest rates may make stocks less attractive, resulting in lower prices.

- Company News and Events: Significant news or events related to a company, such as product launches, mergers, acquisitions, or changes in key leadership, can have a direct impact on its stock price.

Reading The Price Table

When analyzing stock prices, it’s essential to know how to read the price table. The price table provides valuable information about a stock’s performance, including its current price, trading volume, and price changes over time. Here’s how to interpret the key elements of a price table:| Column | Description |

|---|---|

| Symbol | The ticker symbol representing the company’s stock. |

| Price | The current price of the stock. |

| Change | The difference between the current price and the previous day’s closing price. Positive values indicate an increase, while negative values indicate a decrease. |

| % Change | The percentage change in the stock’s price compared to the previous day’s closing price. |

| Volume | The number of shares traded during a specific period, usually a day. Higher volume often indicates higher market interest in the stock. |

Tools For Tracking Bse Stocks

When it comes to investing in BSE stocks, having the right tools to track and monitor your investments is crucial. With the advancement of technology, there are several mobile apps, websites, and brokerage platforms available to help you stay updated with the latest stock prices and trends. In this article, we will explore two essential tools that can assist you in tracking BSE stocks effectively: Mobile Apps and Websites, and Brokerage Platforms.Mobile Apps And Websites

With the convenience of smartphones, mobile apps and websites have become popular choices for investors to track BSE stocks on the go. These tools offer real-time stock prices, market news, and even customizable watchlists to keep an eye on your preferred stocks. Here are a few notable mobile apps and websites for tracking BSE stocks:- BSE India: The official mobile app of the Bombay Stock Exchange provides a user-friendly interface to access market data, stock prices, indices, and corporate announcements.

- Moneycontrol: A comprehensive financial news and investment app that offers real-time market updates, stock quotes, and interactive charts.

- Economic Times Market: The app provides a seamless experience with live stock quotes, expert opinions, and in-depth analysis of the stock market.

- Investing.com: A popular website and app that covers global financial markets, including BSE stocks. It offers real-time quotes, charts, and personalized portfolio tracking.

Brokerage Platforms

If you prefer a more integrated approach to track BSE stocks, brokerage platforms can be an excellent choice. These platforms not only allow you to monitor your investments but also provide trading capabilities. Here are a few renowned brokerage platforms for tracking BSE stocks:- Zerodha: One of the leading discount brokerage platforms in India, Zerodha offers a user-friendly interface and a range of tools to track BSE stocks, analyze charts, and place trades.

- HDFC Securities: A popular full-service brokerage platform that provides comprehensive market research, stock recommendations, and advanced trading tools.

- ICICI Direct: Known for its robust research capabilities, ICICI Direct offers a powerful trading platform with real-time stock quotes, market analysis, and investment advisory services.

Analyzing Stocks For Investment

When it comes to making investment decisions, analyzing stocks is crucial. Understanding the fundamental and technical aspects of a stock can provide valuable insights for making informed investment choices. In this article, we’ll delve into the essentials of fundamental analysis and the basics of technical analysis, equipping you with the knowledge to evaluate stocks effectively.Fundamental Analysis Essentials

Fundamental analysis involves evaluating a company’s financial health, management, and competitive position to determine its intrinsic value. Key factors include revenue, earnings, assets, and liabilities. By examining these fundamentals, investors can gauge the potential for long-term growth and stability.Technical Analysis Basics

On the other hand, technical analysis focuses on historical price and volume patterns to forecast future stock movements. It involves studying price charts, trend lines, and indicators such as moving averages and relative strength. This analysis aims to identify optimal entry and exit points for trades.Diverse Investment Options On Bse

BSE offers a diverse range of investment options to investors, including stocks, bonds, and mutual funds. The BSE stock list with prices provides investors with up-to-date information on the current market trends and helps them make informed investment decisions.Equities And Derivatives

Equities offer ownership in companies; derivatives are financial contracts.Etfs And Mutual Funds

ETFs track specific indexes; mutual funds pool money from investors.Risk Management Strategies

Implementing effective risk management strategies is crucial when navigating the BSE stock list with price fluctuations. By diversifying investments, setting stop-loss orders, and staying informed about market trends, investors can minimize potential losses and optimize their portfolio performance.Diversification Benefits

Diversifying investments reduces risk and enhances returns.Stop Loss And Limit Orders

Setting stop loss and limit orders protects investments from sudden price changes.Case Studies: Success Stories From Bse

Exploring real success stories from the BSE through case studies can provide valuable insights into investment opportunities.

Blue-chip Triumphs

- Reliance Industries showed remarkable growth, increasing investor wealth.

- Tata Consultancy Services demonstrated consistent performance over the years.

Mid-cap And Small-cap Gainers

- Page Industries saw exponential growth, becoming a favorite among investors.

- Manappuram Finance emerged as a strong player in the finance sector.

Staying Updated With Bse News

Keeping track of the latest updates and news on the Bombay Stock Exchange (BSE) is crucial for investors and traders. Staying informed about official announcements and market rumors can help make well-informed decisions in the ever-changing world of stock trading.Official Announcements

Official announcements on the BSE can significantly impact stock prices. Investors closely watch these announcements to gauge the financial health of companies. This information is vital for making timely investment decisions.Market Rumors And Their Impact

Market rumors can cause fluctuations in stock prices. Traders need to differentiate between authentic news and mere speculation. Reacting hastily to rumors can lead to financial losses.

Legal Framework And Compliance

When it comes to the BSE stock list with price, it’s crucial to understand the legal framework and compliance that govern the market. This ensures the protection of investors and the smooth functioning of the stock exchange.Sebi Regulations

SEBI, the Securities and Exchange Board of India, plays a vital role in regulating the securities market. It oversees the BSE and ensures that all trading activities comply with the established rules and regulations.Investor Rights And Protections

Investors enjoy specific rights and protections under the legal framework governing the BSE stock list with price. These include access to accurate and timely information, the right to a transparent and fair market, and protection against fraudulent activities.Future Of Investing With Bse

Discover the future of investing with BSE’s comprehensive stock list and real-time prices, providing investors with valuable insights for informed decision-making. With BSE’s diverse range of stocks and their current prices, investors can strategize and capitalize on emerging opportunities in the dynamic market.Technological Advancements

In today’s fast-paced world, technological advancements are revolutionizing the way we invest in the stock market. The Bombay Stock Exchange (BSE), one of the oldest stock exchanges in Asia, has embraced these advancements to create a seamless and efficient investing experience. With the integration of modern technologies, investors can now access real-time stock data, analyze market trends, and execute trades with just a few clicks.Emerging Market Trends

The BSE has always been at the forefront of emerging market trends, allowing investors to stay ahead of the curve. By closely monitoring market movements and analyzing various indicators, investors can identify potential investment opportunities and make informed decisions.Conclusion: Building A Robust Portfolio

Building a robust portfolio is crucial for long-term financial success. By investing in the BSE stock list with price, you have the opportunity to create a diversified portfolio that can withstand market fluctuations and generate consistent returns. In this conclusion, we will discuss two key factors that can contribute to building a strong portfolio: a long-term investment philosophy and continuous learning and adaptation.Long-term Investment Philosophy

A long-term investment philosophy is essential for building a robust portfolio. Instead of focusing on short-term gains or trying to time the market, it is important to adopt a patient and disciplined approach. By having a long-term perspective, you can ride out temporary market volatility and benefit from the compounding effect of your investments over time. In order to implement a long-term investment philosophy, consider the following:- Diversify your portfolio across different asset classes, industries, and geographical regions. This helps to spread the risk and potentially increase returns.

- Invest in companies with strong fundamentals and a track record of consistent growth. Look for companies with solid financials, competitive advantages, and a clear business strategy.

- Regularly review your portfolio to ensure it aligns with your long-term goals and risk tolerance. Rebalance if necessary to maintain the desired asset allocation.

Continuous Learning And Adaptation

In the dynamic world of investing, continuous learning and adaptation are key to building a robust portfolio. The financial markets are constantly evolving, and it is important to stay informed and updated. By staying ahead of the curve, you can make more informed investment decisions and adjust your portfolio accordingly.